Canadian Legalization of Cannabis : Trial and Mostly Error

"I do my own market research. I ask people, 'Why don't you go to Hobo [legal cannabis store]? They say, 'Legal product tastes bad. It's s--t'. I say, 'Don't worry, I got you."

"People text and come to me from smaller towns and reserves around Ottawa and they are saying there's no place to even buy legal weed."

"So I get it to them, you know?"

[Name protected] black market cannabis dealer

"One of the first things that comes to mind for me when I think about the last year is a reality check. A reality check for everyone; consumers, the government, producers, the public markets. I wish there was something more positive to say."

"There has been such a focus on scale over everything else, that quality in particular got left behind. I think the first miscalculation that took place was when larger companies presumed that if they got the big supply agreements and they were first to market, they would capture all this early market share and that would be a huge advantage for them in the future."

"In the early days, retailers just wanted product. Any kind of product they could get."

"When the metric is growth and you're being rewarded for it by capital markets, government doesn't really come into the fold because it is not a factor in achieving that goal."

Aaron Salz, chief executive, Stoic Advisory Inc., boutique investment firm

"The industry relied on hype so much to get its stock price up so it could raise capital at an efficient level, that it thumped its chest on metrics link 'funded capacity."

"The biggest problem right now is this massive delta we have between what we are harvesting and what we are shipping."

"Unless we are able to magically sell all that product and get almost the entire black market over to purchase legal product very soon, there is going to be a massive supply glut and plunge in prices."

"There is so much margin confiscation. You have the province getting in between this, then the excise tax on every gram, then HST."

Craig Wiggins, independent industry analyst, founder, The Cannalysts

"I don't think we've had an impact on the black market at all."

"The customers we are seeing now are not price sensitive. I think they are brand new to the industry, don't buy from the black market and that's why they are willing to pay such high prices."

"We're all buying from the same government store. Ultimately, prices will go down if we are allowed to directly purchase from the producer or have direct delivery to the consumer."

Trevor Fencott, chief executive, cannabis retail chain Fire & Flower Cannabis Co.

|

| Canopy Growth's Tweed facility in Smiths Falls, Ontario . (Sean Kilpatrick / CP) |

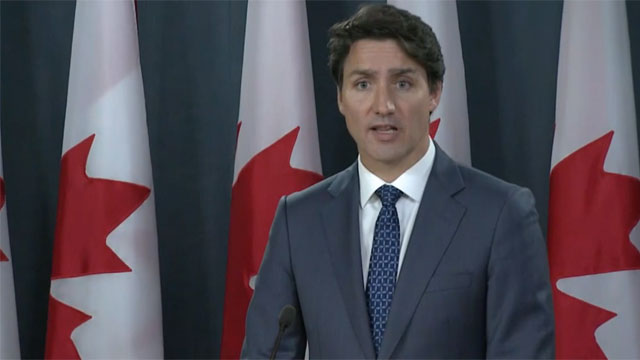

Black market procurers of cannabis boast that their business has, if anything, been growing since the government of Canada legalized recreational cannabis a year ago. The experiment, which was meant to cut out the black market, to provide safe marijuana to users at a reasonable cost, obtainable through provincial government online ordering sites as well as authorized storefronts in approved city locations, appears to have stalled. Initially, accredited producers were in overdrive trying to produce enough product to fill orders and failing, leaving people complaining about the shortage.

The dozens of legal cannabis producers who were overjoyed with legalization and their permits to produce were backed by billions in investor capital, and had expectations of their own that the black market would be hard put to match their sales. Canada, everyone believed, would be on the forefront of an expanding global industry, mass-producing high quality, heavily (health) regulated marijuana. Since then, poor earnings, executive shakeups and mini-scandals have served to send the enthusiastic users back to their usual suppliers.

|

| (Darryl Dyck/The Canadian Press) |

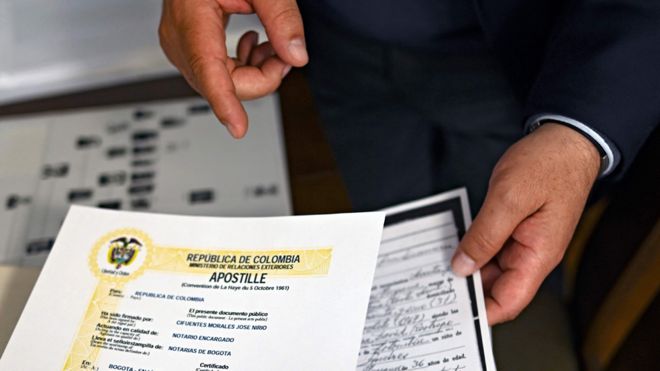

The revelation that the legal market managed to supplant a mere 14 percent of the black market post-legalization has pricked the balloon of excited aspirations. So what went wrong? Mediocre product quality, uncompetitive pricing, a heavy regulatory burden for starters. When the market first opened and product shortage crimped everyone's expectations, large producers like Canopy Growth and Aurora Cannabis promised a consistent product stream but failed to make good on the promise. The provinces blamed the producers, the producers spoke of supply-chain challenges starting with government excise stamp delays, to be pasted on every product.

Once more producers were introduced to the market, the problem of supply was less critical but then people who bought from the legal market seemed to become more aware of quality and choice and found them lacking. Tweed, the Canopy brand, originally dominated the online retail market to acquire over 30 percent of the market, yet more latterly it reports unsold product with demand slipping. While the problem of capacity seemed solved, profit became elusive with mediocre sales failing to offset rising production costs.

And the same appears true of most producers where profit is elusive, an unexpected turn of events given the great, enthusiastic expectations evinced both by producers and the public anxious for legalization to turn the use of coveted cannabis into a world of wonders. Where once the prospect of huge profits loomed following the first year of legalization, the reality is otherwise. The producers began looking outward, to expanding internationally. The CannTrust Holdings rush to boost output began growing in unlicensed spaces leading to an Ontario Securities Commission investigation and license suspension, ruining the company's stock. Haste makes waste certainly proved itself.

|

| (Joe Mahoney/The Canadian Press) |

The paucity of brick-and-mortar stores in Ontario for example, with only 25 permits issued along with the online government-operated store to serve a population of 14 million people represents an obstacle to success. With so few options to buy legally, little wonder the black market is thriving. The price disparity between legal and black-market cannabis is significant, with the average price of legal cannabis $10.23 a gram as opposed to $5.59 on the illegal market; it's a no-brainer. Additionally, most provinces are virtual wholesalers between the licensed producer and the retailer.

Health Canada's extensive rules imposed on producers with its mandate to ensure legal weed sold in Canada meets the highest safety standards has faced criticism about taking the situation too seriously at the expense of the goal to dismantle the black market. Cultivation licences awaiting approval from Health Canada represent a serious backlog, out of the hundreds 221 have so far been approved. "They are not incentivized to move faster because that is not their goal. Their goal is to ensure that the product is safe. It is healthy, from the regulators' perspective, to be slow, because they are turning dials on a brand new policy that could have massive implications down the road", observed an industry insider.

Now, it is the turn of Cannabis 2.0 (production of cannabis edibles, oils, lotions, etc.) to enter the market when licensed producers must begin submitting product applications to the regulator from October 17 forward for a late December or early January product approval. A lag that will no doubt give the black market a great boost. And then there is the vaping health crisis in the U.S., where the use of marijuana-infused vape pens has caused lung infections in users and even deaths.

/https://www.thestar.com/content/dam/thestar/news/canada/2019/10/14/canadas-first-year-of-cannabis-legalization-going-out-on-a-high/pot.jpg) |

"We could say, look, there are structural challenges, but all these additives south of the border that are causing problems with vaping are not even allowed in Canada because of strict regulations. I would argue Canadian companies and our regulatory structure are still looked at abroad as an example of how to legalize. Strict regulation is exactly why Canada will still maintain a first-mover advantage in this industry."Or not.

Graeme Kreindler, analyst, Eight Capital

Labels: Black Market, Canada, Cannabis Legalization, Consumers, Market, Producers