Canada: Use It or Lose It

"This study should be a wake-up call for the federal government.""It has been made abundantly clear that the overarching issue within this industry is the fact that the federal government has created a business environment where Canada will be unable to meet the growing global demand for critical minerals and, therefore, be reliant on other countries to meet our needs.""[The current review process] imposes barriers and represents a serious financial risk for reputable mining companies to move forward with new projects."House of Commons Natural Resources Committee Report"We're talking about the here and now. People have to get with the times and get with critical minerals or they're going to lose."The question is, will we be riding on the crest of that wave, or will we feel the impacts of federal government bearing down on us as opposed to walking in lockstep."Greg Rickford, Minister of Northern Development, Mines, Natural Resources and Forestry, Ontario

|

Ontario Minister Rickford points out that new regulatory hurdles imposed by the federal government declared recently all new projects in the northern "Ring of Fire" region are to be subject to federal environmental assessments. This is the Ontario region known to be rich in chromite, nickel, copper, platinum and other minerals, set to play a vital role in building Canada's supply chains, most particularly if federal funding is provided for the development of provincial resources.

This is in recognition of China tightening its grip on worldwide supplies of rare earths and other crucial materials. Minerals such as magnesium, lithium and cobalt, used in the production of electric car batteries, mobile phone components, solar panels and guided missiles relate to their shortage, constraining production levels. Those same consumer-demanded items will of necessity be sourced elsewhere, as fungible products, if Canada fails to protect its vital natural resources for its own security.

The federal government's failure to secure supply for these strategic materials represents a shortcoming with potential major consequences, in view of next-generation technologies consuming a growing share of the global economy. Canada's immense mineral wealth according to the report, as a result of a weighty regulatory burden, has hampered Canada from tapping into its own critical natural resources.

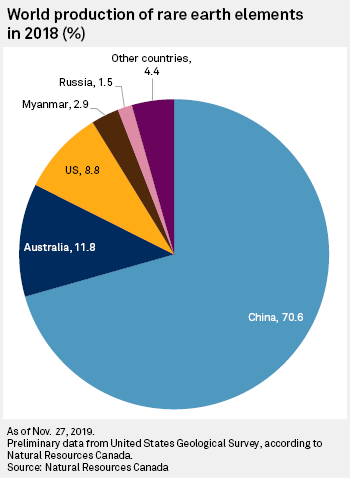

The critical need to secure supply chains for strategic products has become urgent recently in view of sustained efforts on the part of the Communist Party of China to 'corner the market' for supplies of strategic metals, alongside its coveting of the 17 rare earth elements on its way to manipulating prices and supplies. In 2010 China cut the Japanese supply of rare earths, responding to a dispute over the Diaoyu Islands. That measure restricted Japan's capacity to manufacture hybrid cars and other like products.

Canada is being urged by experts to outline a working framework geared to developing and protecting critical minerals; incentives for investment, to national security protection to guard against foreign takeovers of Canadian assets. For decades, China has invested in acquiring strategic mineral assets in Africa and elsewhere. The end result being that it now has possession of fully 80 percent of global processing capacity for rare earths. Around 80 percent of battery chemicals globally are refined in China.

The report urges Canada to deepen ties with Europe, the United States and Japan, in a group effort to strengthen non-Chinese supply chains. The managing director of Benchmark Mineral Intelligence, Simon Moores, informed the committee that China is set to possess 67 percent of global capacity to build lithium-ion batteries by 2030, in large part as a result of significant investments China has made, including a number of "mega factories". Leaving the rest of the world to contemplate the possession of a mere 12 percent.

|

Canada’s critical minerals list: Aluminum, Antimony, Bismuth, Cesium, Chromium, Cobalt, Copper, Fluorspar, Gallium, Germanium, Graphite, Helium, Indium, Lithium, Magnesium, Manganese, Molybdenum, Nickel, Niobium, Platinum group metals, Potash, Rare earth elements, Scandium, Tantalum, Tellurium, Tin, Titanium, Tungsten, Uranium, Vanadium, Zinc. |

Labels: Canada, China, Metals, Natural Resources, New Technologies, Rare Earth Minerals

0 Comments:

Post a Comment

<< Home